On August 3, 2012, the Royal Bank of Scotland attributed to individual behaviour the breaches to the rules of operation of the Libor.

http://www.thejournalofregulation.com/spip.php?article1574

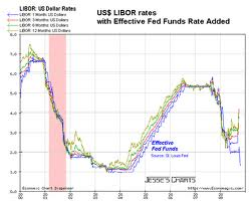

Libor is the rate of Exchange on the interbank market, important in that and also in what it's on the Libor rate that thousands of external financial transactions in interbank relations are based. In this manipulations on the Libor operated by banks are properly catastrophic. What can therefore be a disaster was opened with the sanction of Barclays on 27 June 2012 by the British Financial Services Authority (FSA) for manipulation. Investigations are underway, on multiple grounds, by many authorities on multiple grounds. The statement made on August 3, 2012 by the Royal Bank of Scotland is interesting in that, in the same time that it dismiss them, it said that manipulations that could discover in it are attributable to individuals and only to them. The system was thus not fraudulent. Therefore the declaratory system could be saved.

© thejournalofregulation

The case of the Libor caused the reaction of all actors. Regulators prosecuted, Governments mandated committees to review the system itself, the banks organise their defence system. Barclays pointed out that at the request of the central banker it acted, as a way to move the responsibility to a third party, from inside to outside, the kept operator (commercial bank) to the guardian operator (the central banker) in the system of bank regulation. In this statement on August 3, Royal Bank of Scotland selects first the only way now is to press reports, since the Bank is expressed by an interview given by the CEO of the Bank, Stephen Hester, in the Guardian newspaper. It said having

conducted an internal investigation, in parallel, therefore, those carried out by the public authority (which shows once again the link between control internal and external control) and lay off employees as a consequence, because its investigation would have shown that they have manipulated the Libor. Stephen Hester insists on the fact that that it is to preserve the reputation of the bank, as the case Libor is likely to cause damage to the reputation of all banks.

We can measure, it is about that more "externalise" the responsibility, but to make them respond of the legal entity that is the Bank to individuals that are traders. Although legally the responsibility of the latter does not exclude the liability of the first, but the CEO said the bank is cooperating fully with investigators (those public inquiries). In the "role play" which is often assimilated to the regulation, we can see that the bank and this may correspond to reality because of the information asymmetry it suffers for the benefit of its own traders, wanted to put on those who pursue and not the side of the accused persons.

votre commentaire