The recent news

Feb. 23, 2015

Breaking news

The theme of the relationship between regulation and innovation finds every day new illustrations. The example of the drone is particularly noteworthy.

Indeed, the drone is a technical object that moves in the air without being driven in an immediate way by the hand of man.

The legal mechanism of qualification brought the drone in the category of "aircraft" and submit it to the regulatory power of the civil aviation regulator.

The regulation of civil aviation is primarily a safety regulation, not a regulation of the sector's economic deployment.

This is why regulators have taken restrictive positions on drones used for commercial purposes, to the extent that the presence of human beings, most the pilots, are the condition for the safety of people. The fact that the drones fly with "no one" led to consider as a danger a prior, which led regulators to take restrictive measures on flying drones for commercial purposes, restricton consistent with the regulator's intervention criteria, without taking into account external rules, such as the protection of privacy.

But whatever the sector, regulators see themselves increasingly as economic regulators. If we adopt this perspective, a restrictive approach appears to be nonsense.

In the interests of balance in both approaches, the safety of people and the economic development through innovation, the US civil aviation regulator, the Federal Aviation Administration is developing new rules.

February 11, 2015, Federal Aviation Administration raised the need for a legal framework for commercial drones. The reason for this is economic. As it writes: "It is anticipated that this activity will result in significant economic benefits". Indeed, Article 333 of the 2012 ACT of modernization and reform imposes registration procedure for every commercial unmanned flying object in the sky!footnote-28. But this hinders business development, and therefore the incentive to technical innovation drone.

It was necessary to find a balance between security of persons and lifting of barriers to economic development. This is why the FAA will distinguish between "small" and other drones. The former are particularly useful in agriculture. To the extent that the former do not constitute danger to persons, an exemption from this procedure (Article 333 exemption) may be given concerning them.

One can analyze this evolution of air Regulation in two ways. First, it is for air regulator to take into account fundamental innovation of flying machines with "no one": innovation will be the base of a huge market for which strict regulatory rules could have been the troublemaker. The consideration of the safety of people remains since only drones "small" are allowed. In addition, they will have to remain at low level and away from airports and housing.

Second, the Regulator reacts by pragmatism. The ban on commercial flight drones hasn't prevented investment in this area. So far, the regulator had instead chosen not to react to the open violations of the standards, from the moment that the safety of the people wasn't in danger. The idea of the new conception is to promote this new market by putting the rules protecting the physical safety of people.

Feb. 21, 2015

Breaking news

There was a time when the key was in the rule. Today is essentially in the effectiveness of the rule. What the English and Americans call: Enforcement.

When operators are very powerful and regulators have little information, when the rule is complex, when situations are always changing and diverse, most of the regulatory art focuses on enforcement.

It shows a little more the continuum between Ex ante and ex post, moreover the circularity between them. Not only sanction is necessary ex post to the regulatory body for the rules that it asked ex ante have an effectiveness, but conversely, if we want that breaches the rule that powerful operators are committed could be sanctioned, it is through the Ex ante they must be punished.

Thus, when a financial operator wants to raise funds in the US financial market, he must request authorization from the Regulator to do so or at least to declare beforehand. It is therefore an Ex Ante mechanism. But if the operator is trustworthy, then it can be a kind of privilege that allows him to raise funds without submitting to the heavy and lengthy procedure. It takes but just whether trusted opérator.

However, Reuters reported the next development by the SEC guidelines for applying its power to withdraw the exemption to operators which had broken the law, civil or criminal.

While this may be explained by the fact that these operators have shown they don't deserve the confidence that justified access to the status of "well-known seasoned issuer" (WKSI) offering this "privilege" exempting regulation.

This is especially a new crackdown. The withdrawal of that relief proceedings valuable to the operator who regularly raises funds on the market, making him reach the common lot of borrowers, making carrying a disadvantage compared to operators who respect the law and shall remain holders of "bureaucratic privilege".

In a regulation in which repression becomes the central arrow in the quiver, here is an acute .

It begs the question: claiming that it is within the Ex Ante, can the regulator be dispensed to apply the rights of the defense?

Feb. 20, 2015

Breaking news

Internet needs to be regulated, but by whom and from what criteria?

The high speed building of very different cases shows the urgency of reflections on the principles.

Consider the case in which just entered the British Regulatory Authority Advertising Standards Authority (ASA). Thiss Authority isn't specific to the Internet but the fact the behavior takes place on the Internet doesn't stop the Regulator, the ASA applying its control on "all media".

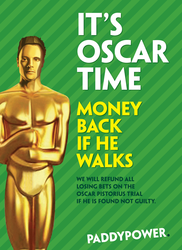

An Irish betting company organized bets about a future event: conviction or acquittal of Oscar Pistorus for the death of his fiancée. The latter doesn't deny being the author of the fatal blow but claims that he isn't responsible legally.

The website reproduces the accused of a very recognizable way in the form of an Oscar statuette. This is due to the homonymous first name and the statue of the reward. But this is also a triple ambiguity created by the company.

Secondly the statue can't walk as the athlete si one takes off his prosthetic that made him win races.

Thirdly and more than that, if convicted, he remains in prison, Oscar Pistorum would continue to be deprived of his freedom to come and go, and therefore still unable to "walk" freely, the betting firm indicating that it will reimburses money if the accused will "walk" (out of prison - as a sort of miracle ...).

_____

Watching that, more than 5,000 people protested. But before whom? In this excess of regulators, people turn to perhaps the most dynamic: in the UK it is probably the Advertising Standards Authority (ASA) .

But what to blame?

One could have said that it is illegal to bet on the outcome of a trial.

One could argue that you can't bet about a terrible history, whose center is the death of a young woman.

But it's rather toward the disability side and "minority rights" that the case is taking shape. Indeed, associations see it as primarily a mockery of people who can't walk.

Without further developed if the ASA takes a position on this advertising that the company has since removed, it will take a strong position in the regulation of the Internet and could for example clarify and prioritize the interests that must be respect in the virtual world.

Feb. 18, 2015

Sectorial Analysis

February 17, 2015, as the previous "Contrat de Régulation Économique" (Economie Regulatory Contract), the firm Aéroport de Paris (ADP) has made available on its site to all "for consultation" the draft "Contrat de Régulation Economique ("Economic Regulatory Contract) for the period 2016 -2020.

Published in the wake of the meeting of the Board of ADP, the text is presented as a tool "for the Paris place", especially for air transport.

This shows that the document is primarily intended for investors and financial markets, the document being placed on the company website in the section for the "investors".

This illustrates the evolution from the traditional "contrats de plan" (plan contracts). But then, who are the parties to these types of contract?

Indeed, the very term "Regulatory contract" is new in public Law. It appears as a sort of modernization of "plan contract." The Conseil d'État (French State Council) finally admitted the contractual nature of these planning contracts. In these contracts, are parties were the State and the company in charge of a public service.

Because here the contract is an instrument of "economic regulation" the open public consultation draft rather expresses a global conception of ADP, the company which manages the Paris airports, for the future of the development of critical infrastructure that is the airport as the heart of global development of air transport.

The enterprise manager of the airport in the heart of the contract (rather than the State) in setting objectives for the coming four years is the letter and spirit of the French law of 20 April 2005 about Airports, which put the apparatus of this "Contrat de Régulation Economique" in place.

In this, the infrastructure manager is set by law as a "regulator of second degree", as can be a financial market enterprise. The company that manages and develops the Paris airports undoubtedly belongs to the category of " critical firms", as well it manages the future of the sector and helps to keep France a place in the world.

More, A.D.P. behaves like a Regulator, since it is carrying out the "public consultation", the consultation paper prepared by it, being placed on its site and developing its ambitions for the sector and for France. But A.D.P. also expressed as a financial and economic actor, emphasizing the competitive environment, demanding in passing more stability and clarity in the regulation in which it moves ...

That is why the consultation mechanism provided by the law must be more complex. Indeed, ADP can not be judge and jury. Therefore if the project raises observations, they must be formuled not to ADP but to the Ministries of Aviation and Economy, within a month. They shall communicate theiir content to ADP . Then the Commission consultative aéroportaire (French Airport Consultative Committee) will be consulted. At the end of this process, the "Contrat de Régulation Economique" will be signed.

Seing the end of the process, it remains in line with the plan contracts, since it remains the Economic Regulatory Contract is signed between the State and the essential infrastructure manager. But the consultation process shows firstly investors are the first recipients of the statements made by a privatized company presenting its draft primarily in terms of competitive context and international development and secondly the airlines that use daily services of the airports are also directly involved by theses questions of tarification.

Airlines protest against the increase in the money that will be asked. This will be imposed, since it is tarification and princing public policy. We are in unilateral rules. But it is indeed a "price" they feel to pay, they also heard a speech referring to competition in what the mechanism is presented as a "contract".

But then, does it take to admit that these "contracts for economic regulation" are not between two parties that are the state and the regulator of second degree that is the infrastructure manager but must be three, the State, the infrastructure manager and "stakeholders" that are mainly airlines?

This practical difficulty is much to the fact that the qualification of "contract" is difficult to justify in proceeding in which prevail unilateral mechanisms.

Feb. 17, 2015

Translated Summaries : 05. Energie

In regulatory law, municipalities are very important, as consumers but also as issuers standards. They can do this through contracts but also by unilateral standards such orders.

This power of municipalities is coming to a halt by the decision taken 17 February 2015 by the Supreme Court of the State of Ohio,, State of Ohio ex rel. Jack Morrison Jr., Law Director for City of Munroe Falls, Ohio v. Beck Energy Corp.

Indeed, a municipal law had made provisions for imposing rules on location, drilling and well operations and gas. These provisions were contrary to the law of the State of Ohio.

In its judgment of 17 February 2015, the state Supreme Court considers that this is enough to make the first non-compliant text of the Constitution because it is not possible for a local authority to exercise normative power by contradicting a state standard.

The stakes are certainly legal and lies in the implementation of the hierarchy of norms. But it is also political: in energy, due to the power of the operators, which is most likely not to be captured by the sector? The political power of the state or the political power of municipalities?

As suggested by one of the judges, must be taken into consideration which of the two powers depends most operators in the financing of campaigns.

Factual and determinant consideration, specific element of the US, an element which Kelsen couldn't think .....

Feb. 16, 2015

Bibliographic Reports : Books

Published by Oxford University Press (OUF), the collective book, Public Accountability, edited by Mark Bovens, Robert Goodin and Thomas Schillemann, consists of 43 contributions.

Few strictly focus on issues of regulatory matters. One can still quote the article by Colin Scott on Independent Regulators or those of Christie Hayne, Steven E. Salterio and Paul L. Posner and Shahan Asif on auditing (Accounting and Auditing; Audit Institutions).

The subject of most of the contributions is rather the necessary renewal of the management of the State, public governance incorporating this new way of "accountability," which explains the book title : itself: Public Accountability. But as we know that the line between public and private is more porous than ever, we can appreciate that the bookk extends its thoughts to the governance of private organizations or non-profit private sector by some contributions.

Indeed, the fact that Accountability is what is common to the Regulation and Governance. This is the first sentence of the book : "Accountability is the buzzword of modern governance".

Probably because of accountability has become a central concept, as shown in the introductory contribution, these are the articles that confront the most general elements such as "time" (Accountability and Time), "crisis" (Accountability for Crise) or "trust" (Accountability and trust), which are the most instructive for the future.

Thus, despite its collective character, the book is very consistent and often takes a critical tone about this invasion of public space by the will of accoutability, the authors emphasizing the "deficits", the failures and especially thet prohibitively expensive of this mechanism.

It would come to regret the simple mechanism of hierarchical rule to which a nostalgic contribution is devoted, which describes how operated the State before we apply to it the State the agency theory.

So it is a practical book, complete, critical and prospective, of great interest.

Feb. 15, 2015

Breaking news

In an article written in French, the press of Senegal reported a conference in which the First President of the Dakar Court of Appeal stated that the judicial court - in the present case the Dakar Court of Appeal - after being a bit "frightened "by the regulatory law, because of its technicality, and after its fear of being dispossessed of cases because of the power of that the regulatory authorities in place to exercise the dispute resolution, is able to play its role today.

He first asserts that judges learned the technic of regulatory matter(in this case, his speech was about the public markets).

He asserts, secondly, that when the parties are in conflict, they continue to go before the judicial court, regardless of the existence of the independant administrative bodies and their dispute resolution function.

Feb. 14, 2015

Sectorial Analysis

The repression is inseparable from how to repress. This is why the procedural difficulties are indicative of underlying fundamental problems. Currently, the basic issue updated by the battles around the procedures of financial sanctions is about the sanction bais.

For the regulator, the penalty is one tool among others to regulate financial markets. The penalty in a continuum with its legislative powers, are its teeth and claws through which financial markets are developing. The purpose of financial policy justifies an objective repression with a probationary system often based on presumptions leading to impute breaches players in some positions on or financial markets. The regulator must have this card in hand and use it according to this method.

Moreover, if it happens that people commit reprehensible misconducts, perceived as such by the social group, they should be punished, possibly up to the prison. Only the criminal justice is legitimate to do so legitimately weighed down by the burden of proving intentionality, etc.

We must distinguish these two types of criminality. It is from there that the two procedures and two probationary systems can take place at the same time but on different offenses.

For now this is not the case, as "financial misconduct" are only the carbon copy of "financial crimes" lightened loads of evidence that protected the defendant and who should answer for now twice.

Procedural problem? No, problem of criminalization, which won't be released by procedural solutions, the most hazardous being to create a new institution, the most calamitous being to weaken the system by removing one of the ways of prosecution. It is necessary to make distinctions in the offenses that are currently redundant.

Thus, repression as a regulatory tool used by the Regulator is in focus, but the real financial criminal law remains to be consolidated to achieve its own and classic goal: punish faults including through the prison.