Breaking news

Nov. 8, 2016

Breaking news

Nov. 3, 2016

Breaking news

Oct. 24, 2016

Breaking news

Sept. 3, 2016

Breaking news

The Basel Committee on banking supervision issues regularly a monitoring report on the implementation of Basel III regulatory reforms.

In August 2016, the seventh issue was published by the Committee as to be taken into account for the upcoming G20 meeting: Implementation of Basel standards. A report to G20 Leaders on implementation of the Basel III regulatory reforms.

In this report, the Committee mesures how national systems gradually implement the prudential reforms they have informally elaborated in common.

All the power derived from the Basel System stems indeed from the fact that it is concentrated; however, it still has to face a 'hard law' issue, as it is necessary to implement the reforms within the national systems in identical terms and in a constrained timeframe.

The Committee indicates in its reports that some countries still face a number of issues regarding this implementation, whether these issues arise from the rules themselves or from the transposition period that the countries are given to implement them. Those same countries tend to justify themselves by saying that banks are to blame for these issues, since they report having trouble adjusting their information system as to satisfy the new requirements.

The Committee underlines the fact that this delay occurs in some countries whereas others are already compliant creates a situation of unfair 'jurisdiction' competition between them, which is all the more concerning since these national systems host international banks: "Delayed implementation may have implications for the level playing field, and puts unnecessary pressure on jurisdictions that have implemented the standards based on the agreed timelines. A concurrent implementation of global standards is all the more important, as many jurisdictions serve as hosts to internationally active banks.".

In order to improve an effective implementation of the whole system, the Committee proposed to implement instead a calculus method that would be less complex: "These proposals would constrain banks’ use of internal models and would reduce the complexity of the regulatory framework.".

____

A few general observations can be drawn from this very specific Basel III issue underlined in the aforementioned report:

- soft law needs at some point to get concrete (which is closely monitored since the rules do need to be implemented), otherwise it is not law at all;

- it is through implementation that the weight and the contours of common rules are actually being felt;

- this situation is a good reminder of the fact that competing jurisdictions are an actual thing and a issue to deal with;

- what is an argument based of complexity, or even impossibility, of the technical implementation of a requirement worth?

This last question is crucial. Those who impose the requirement may consider that the non-enforcement for technical reasons cannot be accepted!footnote-68. Here, however, maybe since it is not a formal requirement as this is all soft law, and since there is a good communication between the supervisor and the executing agent (who is, at the same time, the one that is subject to the requirement, the one who elaborated it and the one who proposes to review it as to make it less complex).

Cass. R. Sunstein's last book was entitled Simpler. French Conseil d’État (French administrative supreme court) conducts thorough work on the quality of laws and on their simplicity, both qualities that probably go hand in hand. The Basel Committee steps in the same directions...

Aug. 1, 2016

Breaking news

Cass R. Sunstein is a prominent Law & Economics teacher (first at the University of Chicago, then at Harvard). Not only has he written reference handbooks on Regulation, he was also the one who inspired the Regulation policies of Obama. In his 2013 book Simpler, he expresses his stance: to be better, public policies need to be simpler.

In this essay, Sunstein explores how behavorial economics might lead to improve public decision-making processes. He bases its stances upon his experience as the Administrator, from 2009 to 2012, of the US Office of Information and Regulatory Affairs; that is why anyone who cares about Regulation should read it and ask themselves if simplicity, as the author states, may or may not be an actual leading principle for an effective government.

The OIRA, under the supervision of the Office of Management and Budget placed within the Executive Office, reviews the draft Regulations that are prepared by the cabinets of various rulemaking agencies. In this view, the OIRA can be regarded as a sort of custodian of the quality of Regulation throughout the US; conversely to the mainly consultative functions granted to the Conseil d'Etat in France, the OIRA's opinions are binding. Hence, a draft project shall not be issued nor be enforced without its prior consent. Part of OIRA's defining mission is also to centralize all the information held by diverse people within the executive branch, as to enable its access and circulation between all the rulemaking agencies responsible for elaborating and producing binding regulations.

Simpler is dedicated to the detailed study of the main decisions taken under Sunstein's decisive influence by the OIRA in the Regulation field during Obama's first mandate (2009-2012). Before taking up government functions, Sunstein focused part of his academic work on the interactions that are the most likely to occur between behavioral economics, law and public policy. To him, "a general lesson is that small, inexpensive policy initiatives, informed by behavioral economics, can have big benefits" (p. 41). He namely provides that "without a massive reduction in its current functions, government can be far more effective, far less confusing, far less counterproductive, and far more helpful if it opts, wherever it can, for greater simplicity" (p. 11).

This reference to 'simplicity', from which the name of Sunstein's essay stems, aims at translating all the efforts done by public authorities, under the supervision of the OIRA, to issue rules that were clearer and more accessible than before and that provided their subjects (whether they are citizens, companies, or federal administrations) a greater freedom in the choices they were able to make.

Throughout his book and with a little help from the various situations he had to face during his term at the OIRA, Sunstein shows that there is a virtuous relationship between a better information of the agents (whether they are the authors or the subjects of the norms at stake), a greater simplicity in public decision-making process and a better quality of the regulations meilleure qualité de la réglementation in force in a State. This paper hence aims to sum up the main points of the essay (I.), before making a few comments about it (II.).

(See below)

July 23, 2016

Breaking news

On 20 July 2016, the Conseil Supérieur de l'Audiovisuel (CSA- French "Independant Authority to Protect Audiovisual Communications Freedom") issued a press release in which it directly addresses to its Turkish counterpart.

Read the 20 July 2016 press release from the CSA.

The press release is short. Here is what it says: "Le Conseil supérieur de l'audiovisuel exprime sa vive inquiétude à la suite de la décision du Conseil suprême de la radio et de la télévision (RTÜK), le régulateur des médias en Turquie, de retirer leurs droits d'émission à de nombreuses radios et télévisions. Le Conseil appelle son partenaire de longue date au sein de la Plateforme européenne des instances de régulation (EPRA) et du Réseau des institutions de régulation méditerranéennes (RIRM) à ne pas mettre en cause la liberté de communication et le pluralisme des médias, garanties fondamentales d'une société démocratique." (courtesy translation: "The Conseil supérieur de l'audiovisual expresses its deep concerns following the decision of the Supreme Council for Radio and Television (RTÜK), the Turkish Media Regulator, to withdraw the broadcasting rights of numerous radios and televisions. The Conseil calls upon its long-time partner within the European Platform of Regulatory Authorities (EPRA) and the Mediterranean Regulation Authorities Network (RIRM) not to jeopardize the freedom of communication and media pluralism, which are fundamental guarantees in a democratic society").

The press release is entitled "Le CSA s'inquiète du retrait par le régulateur turc des droits d'émission de radios et de télévision" (courtesy translation: "The CSA worries about the decision of the Turkish Regulator to withdraw broadcasting rights to radios and televisions").

____

Isn't this surprising?

One would understand that the members of a Regulatory Authority, just as many people, would worry about what has been happening lately in Turkey. One can also share the view that these events might cause them to fear for the sake of public liberties and democracy in the country.

Should a Regulatory Authority express its "worry" though?

Shouldn't it be the Government's role instead, within the framework of its 'diplomatic relations' with the state and with the use of an appropriate vocabulary, to express any 'worry'?

First of all, this is a salient example of the ambiguity of the Audiovisual Regulator. Indeed, while it itself insists on the fact that it acts as an economic regulator of a sector whose development and innovation falls under its watch and monitoring (which namely justifies the fact that he reviews candidacies to the presidency of public televisions channels), the Conseil Supérieur de l'Audiovisuel had initially been created to preserve public liberties.

As such, people who still embrace the distinction that was previously assumed between public liberties regulation and economic regulation still consider the CSA - along with the CNIL - as the prototype of the former type of regulatory body.

Here the CSA expresses its "deep concern" and sends a request not to "jeopardize liberties", which is the polite version of an injunction, to a foreign regulatory authority upon which it has no authority whatsoever.

One can understand that the Regulator develops soft law about operators on which he has actual authority. But what about here? Shouldn't the adage Nemo plus juris apply?

How is the Regulator competent to issue 'releases' in which he formulates desiderata towards a foreign body whose behavior is unappealing to him? Shouldn't the Quai d'Orsay (French Ministry for Foreign Affairs) be in charge?

The Regulator took a political stance here, while it is known that a Regulatory Authority can only be legitimate when it stands as a technical authority; emphasizing on the political features of its job actually jeopardizes this legitimacy, all the more when international politics are involved (which is the case here).

However, the Regulator does preempt criticism in its press release:

It starts indeed by stating that it only expresses this sort of 'feeling' because of the old ties that exists between the French and the Turkish Regulators: it essentially considers that friends can be true to one another, express a few criticism and expect changes. Friendship in the digital media and in politics would allow for many things.

Besides, the CSA recalls the solidarity that prevails between the two regulators. Because they are "long-time partner within the European Platform of Regulatory Authorities (EPRA) and the Mediterranean Regulation Authorities Network (RIRM)", the French Regulator is enabled to express the Turkish Regulators its view on how it is jeopardizing democracy and how it should consequently stop.

Maybe the many ties that exists between the Regulators now enable them to give more or less stringent advice to one another, whereas diplomatic embassies now play an increasing economic role: how blur do the lines get!

July 15, 2016

Breaking news

In Senegal, the Autorité de régulation des télécommunications et des postes (ARTP ; English translation: Telecommunications and Posts Regulatory Authority) has, just like all regulators, inherent powers to impose sanctions. In general, the important thing is not only to exercise this sanctioning power but to exercise it in a way that reinforces the authority of the Regulator. In this perspective, the new Sonatel sanction decision is important.

As a sanctions always carry a heavier weight when people are made aware of it, the Director General of the Artp issued a press release, that has been flagged as particularly important, and held a press conference (in French) on a particularly serious sanction imposed following what the Regulator considers as the non-fulfilment of obligations stemming from formal notices (which, by the way, the telecom operator challenges on the merits).

On 21 November 2014 indeed, the Sonatel was given a formal notice from the Artp to respect consumer rights. As the code of telecommunications provides since its modification in 2014, operators shall "prendre les mesures appropriées de dimensionnement de leurs réseaux de nature à garantir à leurs clients un accès ininterrompu à leur service client commercial ou technique en respectant un taux d’efficacité minimal" (translation: "take appropriate measures to size their networks in a way that provides their consumers with an uninterrupted access to their customer service (sales service and technical support) which would respect a minimum efficiency rate") set by the Regulator itself- as to, namely, ensure that the right of consumers to be informed is satisfied (as regards billing mechanisms) and that their calls to consumer services remain free of charge. As the Regulator estimated that the Sonatel was not complying with such regulations, it conducted a formal investigation and notified a statement of objections to the operator, before sending on 28 January 2015 a second formal notice for the same reasons.

On 14 July 2016, the Regulator imposed a sanction on Sonatel since the it still estimated that the operator's behavior still was not leading to a compliant situation as regards the consumer right to be informed. The sanction, as stated in the Sonatel decision, is 13 billion 959 million FCfa (c. €20m), i.e., 15% of Sonatel's 2015 turnover. The sanction decision also provides that if the operator does not enforce it, an additional penalty of 10m FCfa (c. €15,000) per day will be charged.

The operator, however, challenges this sanction insofar as it estimates that its behavior is not to be blamed. To support its claim, Sonatel avails itself from the fact that upon reception of the first formal notice, it undertook a 'progressive compliance' with the requirements process as regards its network, then let the Regulator know about it, etc. It is henceforth to lodge an appeal.

The issue at stake, therefore, is to know whether the obligations on operators are obligations regarding the means used (that is to say, means obligations), or, conversely, if they are obligations to produce results (performance obligations). If they are means obligations, then the operator is right. However, considering the efficiency and effectivity principes that are closely linked with the teleological nature of Regulation, it is more likely that such obligations are performance obligations.

For instance, in France, the Commission Informatiques et Libertés (French Data Protection Authority- CNIL) considered on 1 March 2016!footnote-42 that the obligations on operators to have accurate and complete data are performance obligations and not mere means obligations.

Thus, there is probably more to follow with this Sonatel decision. The day the press release was issued, the operator stated it intended to lodge a hierarchical appeal before the Minister.

The next day, the Director General of the Artp stated in the press (in French) that under the Senegal law, the appeal could only be lodged before a jurisdiction, or before... the Regulatory Authority itself (request for reconsideration - in French : "recours gracieux").

This situation is thus a great reminder that new illustrations of the interplays between Regulation and Politics can always be found.

July 6, 2016

Breaking news

The British want to be first in the upcoming digital economy.

That is why a draft 'Digital Economy' bill has been introduced.

July 4, 2016

Breaking news

Speaking to the press is a way for the Regulator to reach everyone, including policymakers, European institutions, and fellow Regulators who also seek to compete for space in the digital area.

As he reported: "Nous arrivons aujourd’hui, avec l'irruption du numérique, à un acte 2 de la régulation. Il y a 20 ans, on est passé du modèle PTT où l’Etat produisait le service public, au modèle d’État-régulateur qui a permis l’ouverture à la concurrence. Ce modèle vise à une bonne organisation du marché avec des outils de pilotage efficaces, mais parfois très intrusifs : les licences mobiles, qui sont des contrats assortis de sanctions administratives en cas de non-respect des obligations, ou le dégroupage, qui est une intervention sur la propriété privée… Aujourd’hui il nous faut franchir une étape nouvelle et nous projeter dans la suite, repenser nos outils pour permettre, en complément, une régulation plus focalisée, plus humble et plus agile". We can translate this passage as it follows : “As of today, considering the onset of digital, we are getting to a second phase for Regulation. Over the past 20 years, we went from the ‘PTT model’, where the State provided for public service, to a new Regulatory State model that enabled competition to thrive. This model aims for good market organization with effective management tools, which may be sometimes very intrusive: e.g., mobile licenses, which are agreements that include administrative penalties in the event of failure to comply with its provisions, or unbundled access, which relates to a State intervention on private ownership… Today, we need to take it another step further and plan for the future, reconsider our tools to allow for a Regulation that would be better focused, humbler and nimbler”.

Whatever “Phase 1” was would thus be already outpaced. Farewell stringent public service, so long market openings to competition. Such an understanding of Regulation was certainly consistent with the idea that Regulation was only meant to be temporary, namely considering the everlasting protection of personal data by the dedicated supervisory authority (Commission Nationale Informatique et Libertés, CNIL)…

We would then need to implement “Phase 2” and, as Sébastien Soriano advises, to “Regulate by the multitude”, which is "a concept that includes consumers, but also users, observers, and the civil society as a whole. The key question is how to use the power of information to get the greatest possible leverage on the market while relying on the multitude. The answer is clear: Regulation by data" ("La multitude, ce sont les utilisateurs, les observateurs, la société civile. Cela inclut les consommateurs, mais pas uniquement. Et la question centrale, c’est comment utiliser le pouvoir de l’information pour avoir un maximum d'effet de levier sur le marché et grâce à la multitude. La réponse, c’est la régulation par la data.").

Like all the others, the Telecom Regulator introduces himself as a sort of ‘natural’ Regulator for digital activities, as he relies on the key notion that is information. In doing so, he is seeking allies that are just as natural as he is— that is to say, consumers. Consumers fall indeed into the scope of the Regulator insofar as they provide him with the information he needs to Regulate the digital sector and space.

The Regulator thus does not define himself anymore as the one that protects consumers against the market, but as the one that binds the two together, transforming the complaint into a civic act: “There’s a problem. As a consumer, I am alerting you as a Regulator who has the means to regulate market failures and whom I shall let operate”.

In such a statement, the ARCEP not only becomes the ‘natural’ digital Regulator, but it also become the one that operates on the grounds of information brought by the web-user, who is protected by and who somehow benefits in return from the action of the Regulator.

Two concluding thoughts:

- What a nimble reasoning indeed from the Regulator, who had initially been created to be the ‘container Regulator’, and who is now becoming, since Phase 2 is on its way, a kind of ‘overall’ Regulator that regulates both the container and the content.

- This is a salient example that rationales and frameworks that were developed by the Banking and Financial Regulation are modelling Regulation in general: see whistleblowers, information, obsolescence of the ‘public service’.

June 24, 2016

Breaking news

The Autorité des Marchés Financiers (AMF- French Prudential Supervision Authority) set up a Scientific Advisory Board under the supervision of its president Gérard Rameix, who is also president of the AMF.

The Scientific Advisory Board chose ‘Financial education in the digital era’ as the theme of its annual conference, which was held on 20 June 2016 in partnership with Paris School of Economics.

The conference was opened by François Villeroy de Galhau, Governor of the Banque de France (France’s central bank). He stated that financial literacy “shall help everyone make informed decisions”. In this regard, financial literacy is a “factor for economic efficiency and social fairness”, which justifies involvement from public authorities- including, namely, the Banque de France. In partnership with both the Autorité de Contrôle Prudentiel et de Résolution (ACPR- French Prudential Supervision Authority) and the AMF, the Banque de France ought to be a “caring educator, but an attentive regulator”, as it is “imperative that financial literacy and Regulation should be taken forward jointly, as to allow for new technologies to develop, which would be understood by all and for the benefit of all”.

Three roundtables followed. The first roundtable aimed at assessing financial literacy trends and their impact on the financial behaviour of consumers and investors in Europe. The second session focused on the opportunities opened up by new technologies (upon which Fintechs, e.g., crowdfunding platforms, data aggregators and automated financial advice services are thriving) as regards financial behaviours. Lastly, the third panel discussion, which involved several French (AMF, Institut National de la Consommation- INC, French National Institute for Consumer Affairs) and European (European Commission) Regulators, draw conclusions from the first two roundtables and discussed on the issues that an increasingly digitalised financial education raises for Regulatory authorities.

Since this conference raises many crucial questions for Regulation, it is important to recall what has been said in the panel discussion on the role of Regulator with regards to financial education (I.) before sharing some thoughts on this matter of particular interest (II.).

June 22, 2016

Breaking news

It is sometimes argued that the competitive freedom will destroy the "old regulated world", platforms being the perfect example of this fresh wind, the invention of the adjective "disruptive" which could express a "novelty" before which it is only suitable to bow.

It would be therefore necessary to smile or even laugh, what would be a "rearguard battle" when the Conseil Constitutionnel (French Constitutional Council) in a decision of 22 May 2014 had limited the expansion of Uber, protecting the correspondingly monopoly holders of a municipal taxi license.

But in the US, cities adopt regulations. So on the next city council of the city of Chicago, will be proposed the vote of an order to compel the rideshare drivers.

In 2014, the French Constitutional Council justified its decision by referring to "the public order of parking", which the municipality is mistress... The justification given here is to protect the occupant.

Indeed all rideshare drivers will be obliged provide proof that they are subject to health checks, especially on drugs and provide criminel check also.

This is justified because Regulation of an activity implies control of those who exercise it and equal competitors can justify that for the same activity some are removed, especialy in view of the protection of the person transported.

The third new requirement is of a different nature: the driver must prove that it is not in debt to the municipality. Why not, since the infrastructure of the city allows them to exercise the economic activity in question. This is another underlying objective, which lies rather in the idea of an exchange between the city and the one who transports people, the beneficiary of infrastructure should not be otherwise debtor that it enjoys public infrastructure.

The latter provision shows that the "contract" is increasingly not between the carrier and transported - via the virtual platform - but between the very concrete public space and one that circulates and do not live there.

June 21, 2016

Breaking news

June 20, 2016

Breaking news

Little is known about how to ‘regulate the Internet’…

Outline solutions, however, do seem to have to be found in ex-post mechanisms since Regulation (broadly speaking) understand ex-ante and ex-post mechanisms as a continuum, and since Regulators increasingly concentrate ex-post mechanisms in their hands as an effective way to ensure execution of the ex-ante prescriptions they themselves elaborated.

Ex-ante mechanisms aim at making algorithms more ‘loyal’.

As long as we hope for devices to be trustworthy and to be held accountable for their ‘loyalty’, we give merits to the idea that we probably should “take liability seriously”.

On June 14, 2016, the Californian father of one of the victims of the 11/13/2015 Paris attacks filed a suit in a U.S. District Court to prosecute Google, Facebook and Twitter.

The legal dispute is clear.

The applicant based its claim to hold the companies liable on the grounds that they let terrorist groups use their networks: “The suit claims the companies “knowingly permitted” the Islamic State group, referred to in the complaint as “ISIS”, to recruit members, raise money and spread “extremist propaganda” via their social-media services”.

Conversely, the defendants unanimously claimed that they had actively implemented ‘policies’ against extremist material, and that they were working with law enforcement entities to improve regulations on the matter. Self-regulation and ethics versus common liability law.

The companies also pointed out the fact that they were not publishers, hence they could not face liability for the material users post on their networks. This is not, however, the issue at stake: the complaint concerns the use of the network not as a mere way to broadcast messages, but as a way to recruit murderers, provide them with convenient tools to communicate and to prepare criminal operations—allegations for which law does not exempt social media companies from liability.

These allegations are worth being ‘taken seriously’, should the law be unclear on whether the companies could be charged indeed, and should the total exemption from liability of such companies pleading for their ‘neutrality’ be the exception rather than the norm.

The question of principle is thus as follows: is exemption from liability of those who hold the ‘digital space’ together really the norm?

If so, their exemption from liability needs to be extended to a scenario that had not been covered by the law yet. If not, then common liability law is the rightful legal basis to assess whether the companies can be found liable or not—provided that a direct causal link between the unlawful act and an actual harm suffered by the applicant can be demonstrated.

The legal dispute is clear.

June 16, 2016

Breaking news

Professor Hervé Causse released a book of over 800 pages: Droit bancaire et financier (Banking and Financial Law).

Typically, there are "Banking Law" on one side and "Financial Law" on the other, each giving rise to separate books, Banking Law having long since detached from the Commercial Law and do having never really left Civil Law, Financial Law being more subject recently of books.

Typically, there are the "Banking Law" on one side and the "Financial Law" on the other, each giving rise to separate books, banking, having long since detached from the Commercial Law and do having never really left the Civil Law, financial law being more subject recently of books.

In the books of "Banking Law", we find the contracts, transactions (credit), mechanisms (like money), institutions (such as the National Central Bank) and sometimes specific repressive rules.

In the books of "financial law", first of all, we meet financial market, financial transactions (like all securities transactions or takeovers bids), the economy is much more present, the US Law being at home because of extraterritoriality as either model, repressive rules slipping everywhere, to the heart of what appears to be today a branch of law.

The important work of Hervé Causse goes further and corresponds to reality: it merges the Banking and Financial Law.

He does it because his work is based on the life of the sector, that is to say the professionals. In fact, professionals work in banks. Then he describes those who admit and control their activities, that is to say the authorities of supervision and regulation. He goes on to describe to the reader the instruments, financial prowess that the bankers invent.

Thus sucked by financial reality, what is left of the civil commitment of Banking Law? To take just one example, when the author discusses the concept of "banking service" from that of "financial service", he finds the uncertainty of this notions. The Banking Law is thus trying to forget the Civil Code, the “deposition” techniques being one example.

Thanks to the book of Hervé Causse, the reader understands that the rules now being written by those designing financial regulation, these rules must find their bones in the financial regulatory system.

June 14, 2016

Breaking news

On 9 June, the SEC made an announcement on its website.

- The Regulator itself issued the amount of the award to a whistleblower for having providing it with information. Why is that? One would usually take a lower profile when awarding this much money ($17m) to an informer… Conversely, the Regulator immediately and publicly announced it in a press release, which pretty looked like a tender offer for further denunciations. It even included a link for everyone to access the whistleblower program—which is easily funded, since the awards are charged on the fines imposed on the convicted operators thanks to the information given.

- The reason for this is that information from whistleblowers is not merely indicative, nor a second-best option; it is central to Regulation, since it leads the Regulator to get information people within the system (i.e., insiders) deliberately chooses to ‘blow’ (in fact, not only do informers blow the whistle—they often immediately provide the Regulator with substantial information).

- The press release includes justifications for the Regulator’s behaviour, as the SEC openly considers that rewarding whistleblowers is the most efficient way for the Regulator to open or to resolve investigations. The Director of the SEC’s Division of Enforcement stated indeed that “company insiders are uniquely positioned to protect investors and blow the whistle on a company’s wrongdoing by providing key information to the SEC so we can investigate the full extent of the violations”.

- This highlights the ambivalence of insiders. Accordingly, they need to be ‘inside’ the system to be ‘knowledgeable’ and, consequently, obtain privileged information. On the one hand, should they use this information for themselves, then they would face prosecution for market abuse; on the other hand, however, if they use it to stir up the Regulator and shift its attention towards the whistle they’re blowing, then they may earn just as much money, if not more, than if they had behaved in a way that would have led them to prison.

The stage is thus set for the "business of virtue" to thrive.

March 25, 2015

Breaking news

Read the Seminar program (14h - 19h30).

Its issue is the concept of "conflict of interest" by confronting the financial techniques of risk assessment and legal responses developed about it on the rating agencies, especially in 2009.

Speakers are Thomas Aam, Thierry Bonneau, Björn Fasterking, Markus Krall, Frédéric Lobez and Jean-Claude Werrebrouck.

Inscriptions : dherbaut@univ-lille2.fr

Information : marjorie.eeckhoudt@univ-lille1.fr

____

March 12, 2015

Breaking news

The regulation of electronic communications is carried in India by an independent regulator, the Telecom Regulatory Authority of India - Trai..

This regulation aims in particular to develop competition in an important domestic market. For the development of competition, should be encouraged not only increase in consumption, new uses, innovation, but also the competition between suppliers.

For this, the portability of telephone numbers is essential. We find this issue of portability in other sectors, such as financial or energy sectors, but it is in the area of the phone portability turned into right because it is through the number that the person is called, or classified, or recognized

This portability is imposed with difficulty by regulators. The situation in India demonstrates.

The principle of number portability in the mobile phone sector was made by a regulation in 2009 by the Telecommunication Mobile Number Portability Regulations of 23 September 2009, the eighth addressing this issue.

Almost every year, a regulation adds to the previous regulations on this point. Thus, February 25, 2015, the regulator adopted a regulation 4 pages carrying the 6th amendment of the original text.

After the new system adopted by the regulator at the request of the Government who sent a letter to this effect November 23, 2014, as apparatus shown to increase the effectiveness of portability, it is mandatory that from may 3, 2015, any subscriber can change operator while keeping his phone, regardless of his place of residence in the country.

The difficulty comes precisely from the geographical vastness of the country, divided into 22 telecom service areas (called "circles"), the customer physically moving from one to another still having difficulty keeping his number.

Beyond the difficulty of passing the enactment of a principle to the reality of its application, since 6 years apart from each other, here we measure the importance of geography in Regulation.

Feb. 23, 2015

Breaking news

The theme of the relationship between regulation and innovation finds every day new illustrations. The example of the drone is particularly noteworthy.

Indeed, the drone is a technical object that moves in the air without being driven in an immediate way by the hand of man.

The legal mechanism of qualification brought the drone in the category of "aircraft" and submit it to the regulatory power of the civil aviation regulator.

The regulation of civil aviation is primarily a safety regulation, not a regulation of the sector's economic deployment.

This is why regulators have taken restrictive positions on drones used for commercial purposes, to the extent that the presence of human beings, most the pilots, are the condition for the safety of people. The fact that the drones fly with "no one" led to consider as a danger a prior, which led regulators to take restrictive measures on flying drones for commercial purposes, restricton consistent with the regulator's intervention criteria, without taking into account external rules, such as the protection of privacy.

But whatever the sector, regulators see themselves increasingly as economic regulators. If we adopt this perspective, a restrictive approach appears to be nonsense.

In the interests of balance in both approaches, the safety of people and the economic development through innovation, the US civil aviation regulator, the Federal Aviation Administration is developing new rules.

February 11, 2015, Federal Aviation Administration raised the need for a legal framework for commercial drones. The reason for this is economic. As it writes: "It is anticipated that this activity will result in significant economic benefits". Indeed, Article 333 of the 2012 ACT of modernization and reform imposes registration procedure for every commercial unmanned flying object in the sky!footnote-28. But this hinders business development, and therefore the incentive to technical innovation drone.

It was necessary to find a balance between security of persons and lifting of barriers to economic development. This is why the FAA will distinguish between "small" and other drones. The former are particularly useful in agriculture. To the extent that the former do not constitute danger to persons, an exemption from this procedure (Article 333 exemption) may be given concerning them.

One can analyze this evolution of air Regulation in two ways. First, it is for air regulator to take into account fundamental innovation of flying machines with "no one": innovation will be the base of a huge market for which strict regulatory rules could have been the troublemaker. The consideration of the safety of people remains since only drones "small" are allowed. In addition, they will have to remain at low level and away from airports and housing.

Second, the Regulator reacts by pragmatism. The ban on commercial flight drones hasn't prevented investment in this area. So far, the regulator had instead chosen not to react to the open violations of the standards, from the moment that the safety of the people wasn't in danger. The idea of the new conception is to promote this new market by putting the rules protecting the physical safety of people.

Feb. 21, 2015

Breaking news

There was a time when the key was in the rule. Today is essentially in the effectiveness of the rule. What the English and Americans call: Enforcement.

When operators are very powerful and regulators have little information, when the rule is complex, when situations are always changing and diverse, most of the regulatory art focuses on enforcement.

It shows a little more the continuum between Ex ante and ex post, moreover the circularity between them. Not only sanction is necessary ex post to the regulatory body for the rules that it asked ex ante have an effectiveness, but conversely, if we want that breaches the rule that powerful operators are committed could be sanctioned, it is through the Ex ante they must be punished.

Thus, when a financial operator wants to raise funds in the US financial market, he must request authorization from the Regulator to do so or at least to declare beforehand. It is therefore an Ex Ante mechanism. But if the operator is trustworthy, then it can be a kind of privilege that allows him to raise funds without submitting to the heavy and lengthy procedure. It takes but just whether trusted opérator.

However, Reuters reported the next development by the SEC guidelines for applying its power to withdraw the exemption to operators which had broken the law, civil or criminal.

While this may be explained by the fact that these operators have shown they don't deserve the confidence that justified access to the status of "well-known seasoned issuer" (WKSI) offering this "privilege" exempting regulation.

This is especially a new crackdown. The withdrawal of that relief proceedings valuable to the operator who regularly raises funds on the market, making him reach the common lot of borrowers, making carrying a disadvantage compared to operators who respect the law and shall remain holders of "bureaucratic privilege".

In a regulation in which repression becomes the central arrow in the quiver, here is an acute .

It begs the question: claiming that it is within the Ex Ante, can the regulator be dispensed to apply the rights of the defense?

Feb. 20, 2015

Breaking news

Internet needs to be regulated, but by whom and from what criteria?

The high speed building of very different cases shows the urgency of reflections on the principles.

Consider the case in which just entered the British Regulatory Authority Advertising Standards Authority (ASA). Thiss Authority isn't specific to the Internet but the fact the behavior takes place on the Internet doesn't stop the Regulator, the ASA applying its control on "all media".

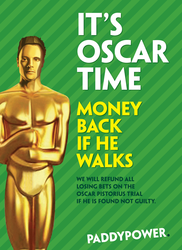

An Irish betting company organized bets about a future event: conviction or acquittal of Oscar Pistorus for the death of his fiancée. The latter doesn't deny being the author of the fatal blow but claims that he isn't responsible legally.

The website reproduces the accused of a very recognizable way in the form of an Oscar statuette. This is due to the homonymous first name and the statue of the reward. But this is also a triple ambiguity created by the company.

Secondly the statue can't walk as the athlete si one takes off his prosthetic that made him win races.

Thirdly and more than that, if convicted, he remains in prison, Oscar Pistorum would continue to be deprived of his freedom to come and go, and therefore still unable to "walk" freely, the betting firm indicating that it will reimburses money if the accused will "walk" (out of prison - as a sort of miracle ...).

_____

Watching that, more than 5,000 people protested. But before whom? In this excess of regulators, people turn to perhaps the most dynamic: in the UK it is probably the Advertising Standards Authority (ASA) .

But what to blame?

One could have said that it is illegal to bet on the outcome of a trial.

One could argue that you can't bet about a terrible history, whose center is the death of a young woman.

But it's rather toward the disability side and "minority rights" that the case is taking shape. Indeed, associations see it as primarily a mockery of people who can't walk.

Without further developed if the ASA takes a position on this advertising that the company has since removed, it will take a strong position in the regulation of the Internet and could for example clarify and prioritize the interests that must be respect in the virtual world.

Feb. 15, 2015

Breaking news

In an article written in French, the press of Senegal reported a conference in which the First President of the Dakar Court of Appeal stated that the judicial court - in the present case the Dakar Court of Appeal - after being a bit "frightened "by the regulatory law, because of its technicality, and after its fear of being dispossessed of cases because of the power of that the regulatory authorities in place to exercise the dispute resolution, is able to play its role today.

He first asserts that judges learned the technic of regulatory matter(in this case, his speech was about the public markets).

He asserts, secondly, that when the parties are in conflict, they continue to go before the judicial court, regardless of the existence of the independant administrative bodies and their dispute resolution function.

Feb. 13, 2015

Breaking news

Read the conference presentation (this presentation is written in French).

Jan. 23, 2015

Breaking news

What does Regulating to operators? How do they feel? Do they internalize? Does it means to them, simply a cost or an impact on their strategy on the markets?

The question is all the more important that you adhere to the theory of incentives, whereas the adequate regulatory techniques are those that produce the desired behavior by regulated operators.

The issue is not whether the Regulating is included in spending. This is acquired. For example, in two years the banks move internal forces of certain services, such as credit, to the compliance department and regulation. The regulation may represent a very high share of costs: it lies in the fact that through compliance the regulatory system has internalized the costs of regulation in the firms.

But does it make to change the strategic choice of the operator on the market, not only increase the number internal processes?

To listen Lloyds Blankfein, chairman of Goldman Sachs in Davos, words immediately commented in the British press as considerations allayed regarding Regulation!footnote-22, we doubt it.

Mr. Blankfein Lloys who also sits on the board of the Harvard Law School, asked about the question of whether the bank doesn't suffer from the pressure of regulations and supervisors replied that must be considered especially in the very design of technical systems to meet compliance but that for him, Regulation isn't really an annoyance: it is a "background noise". He compares it to music: something that he listens a lot, but while he is doing its job. Something which remains outside.

This means that Regulation occupies its technical regulatory services but doesn't affect its own work of invest bank president.

We can rejoice, since it shows that Regulation doesn't impede free enterprise and the operator's choice. One might worry if Regulation should have an "educational" function wanting influence how the president himself decides. In this case, Regulation must cease to be a kind of expensive elevator music.

It is not sure that regulators and supervisors have the same understanding

Jan. 21, 2015

Breaking news

Just released the book of Sofia Ranchordiàs, Constitutional Sunsets and Experimental Legislation. This topic is particularly important in regulatory systems where this method is used very often.

As soon as Legislation is case management, it becomes a matter of time, good timing, and efficiency.

Because the figure of the Law has changed its terms should change. The most appropriate law then appears the "experimental law", the "trial law." This ephemeral legislation as regulatory bodies promote, can claim to be part of the future only if it has "successful". Operators must be good students if they want to conserve the Law!footnote-14.

Thus, the law is only a draft and it is its success that allows the standard access to the status that was natural: the Act that applies to the future.

These precarious laws that certains authors and regulatory bodies present as the right model, challenge the constitutional principles, the Constitution itself being the supreme law governing the future.

This book shows the extent to which notions of efficiency, testing, flexibility, can attack the very idea of Parliament Law and Constitution. It is true that in regulatory systems everything becomes simple regulations, including laws but it is also true that constitutional courts are restive to admit "experimental laws".

Cet ouvrage montre jusqu'à quel point les notions d'efficacité, de test, de flexibilité, peuvent attaquer l'idée même de Loi et de Constitution. Il est vrai qu'en Régulation, tout ne deviendrait que réglementation, y compris la loi et il est vrai que les cours constitutionnelles sont rétives à admettre les "lois expérimentales".

Jan. 19, 2015

Breaking news

We hardly listen to to sermons. This is probably why Alain Supiot puts us on the table the text of Bossuet only occupying few pages, but since 1659 occupies the minds on "l'éminente dignité des pauves" (the eminent dignity of the poor). When Bossuet speaks of wealth and poverty, economists have interest in reading it. When Bossuet speaks of just order and "rightful place", lawyers must read it.

Alain Supiot comments it by writing to the following "Le renversement de l'ordre du monde" (The reversal of the order of the world).

Bossuet reminds that wealthy people think everything is owed to them while grace is given to the poor. Bossuet contends that rich people have interest to share with the poor, for thus it can alleviate the wealth that overwhelm them and they can enter the community (composed by the Church) in which poor people occupy the first place by natural order.

In his study, Alain Supiot looks back on the very definition of 'poverty', which accounts for the money the individual has. He takes up the theme of Bossuet to assert that, contrary to what the result of statistical methods (how much per person per day), the wealthy are "poor" since the market isolates them, spreading them of solidarity. Yet the natural order should lead them to share, by paying taxes, and other mechanisms through the welfare state. But he notes that the State departs increasingly this function, drawn in by this model only wealthy (the "rich-poor"), the only available model becoming what Alain Supiot calls "le marché total" (total market)!footnote-15.

We can no share this view of the world, for example if it is believed that the rich share (Social Responsibility Company theory), or if one believes that the state - sort of church - was often selfish, but already listen to the first advice: read Bossuet.

Reading the Union Address by President Barack Obama of the 21th of January 2015 themed fair sharing between rich and poor by public redistribution, we think back to Bossuet.