The British Government has given to the Financial Services Authority (FSA) the study of the reform of the Libor. Works are expected to the end of September 2012.

http://www.thejournalofregulation.com/spip.php?article1570

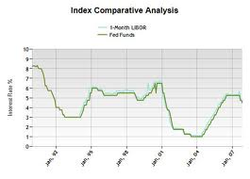

The Libor is the rate of the interbank market practised in the United Kingdom. A large number of financial operations are based on it. So far, its daily development is grounded on a declaratory system on the part of the banks. Since the conviction of Barclays on June 27, 2012 by the Financial Services Authority (FSA) and the general suspicion that a very great banks have contributed to manipulations of the Libor, the relevance of the system itself is questioned. While investigations and prosecutions was put in place for the past in all countries, British Government give to the Financial Services Authority (FSA) study of reform of a Libor, either to detach itself from a declaratory system, or to keep an eye on it and internalize effective sanctions. The report, which will serve as a basis for the reform will be made the end of September 2012.

© thejournalofregulation

Regulation progresses through its failures because failures are all information. Thus, as the financial crises, manipulations and scandals such as Libor, leads to, at the same time that the actions to sanctions of the operators (back to the past) to actions towards a reform of the system revealed thus failed.

Indeed, that revealed the decision to sanction by the Financial Services Authority (FSA) of Barclays on June 27, 2012, then the other actions initiated by the other regulators or Governments; it is probably the inadequacy of Libor itself. This is why the Government of United Kingdom entrusted at the end of July 2012 to Martin Wheatley, Chief Executive of the FSA, the mission to rethink the system of interbank rate (Libor).

The Government asked it to rethink its "governance" and to consider the placement of the process under the supervision of the Financial Services Authority (FSA). It was rethinking the place of self-regulation in banking regulation itself, embed in the financial regulation. In this governance it should be also include sanctions, more immediate, more effective.

The mission is also open, since the Government proposed to the CEO therefore mandated to design alternative models. It should be noted first that it is the financial regulator and not to the Bank of England to which the mission has been entrusted, while it is a banking question.

This is due to the objective fact that Libor is the rate on which is based financial transactions, but also this is because on the fact that the subjective is that it is also the financial regulator which, by its decision to sanction Barclays gave the alert, and not the central banker, exercising yet the supervision on banks.

More importantly, the fact that the Barclays said today that it acted on the orders of the central banker, which makes it impossible to entrust it with the task of thinking the system with the required distance. Secondly, it should be noted that the mission is not in it directed against the banks, or even the declaratory system, but against the control of it. It is necessary that a body checks what the banks reported.

There is then a shift of competence to the Central Bank towards the financial regulator. This means a shift of confidence from one to the other. This is noteworthy because the standards of Basel III express on the contrary a loss of confidence in financial regulators and a report of trust in central banks. It is possible that the case of the Libor, revealing a system, operates a pendulum movement.

In third place, and finally when the competent bodies will examine the behaviour of commercial banks initiated proceedings, it will require a reposition in that the system was at the time, that is to say, a self-regulating system, which the Financial Regulator was almost out and in which the sole contact of commercial banks was the central banker.

your comment